Bank Guarantee Process

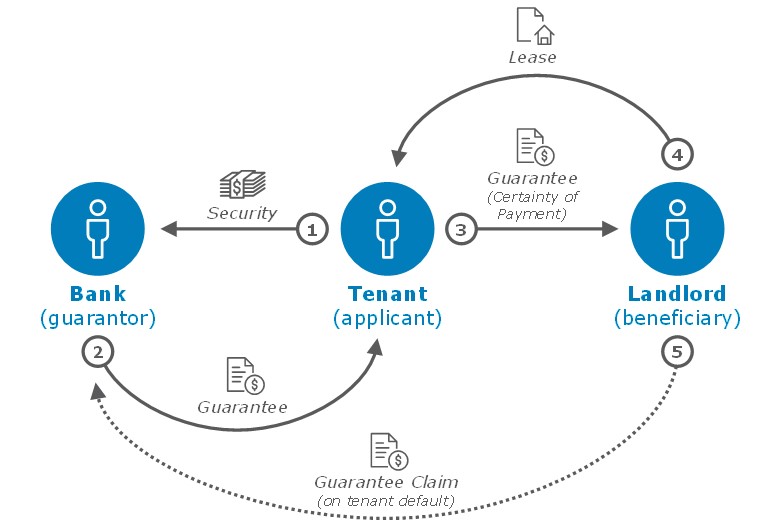

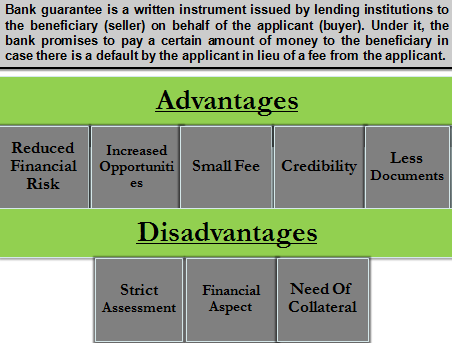

A bank guarantee is a guarantee from a lending institution ensuring the liabilities of a debtor will be met.

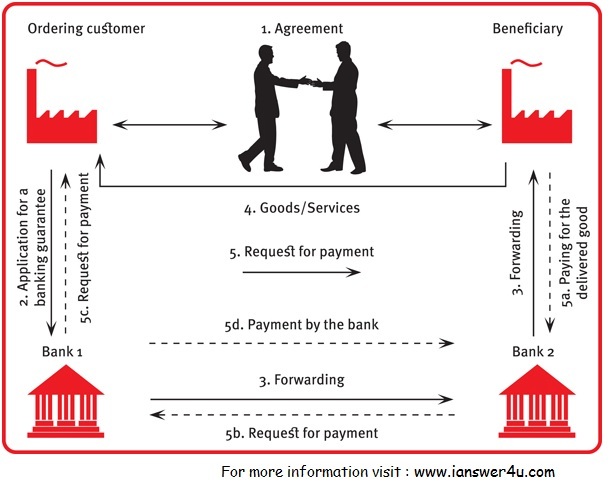

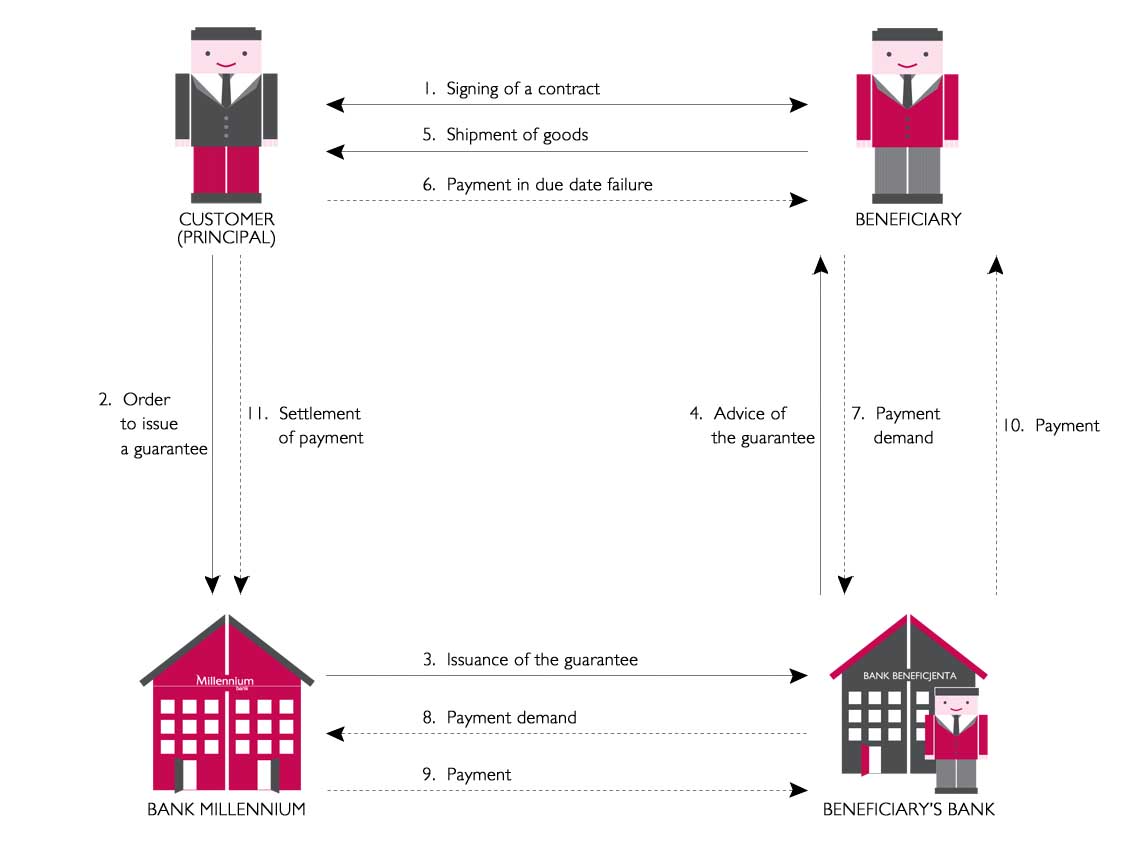

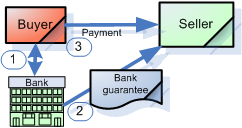

Bank guarantee process. A performance guarantee kicks in if services or goods are not provided to the buyer by the seller as per the specifi cations mentioned in the contract. A bank guarantee empowers the debtor to acquire assets or draw loans in orders to expand their business activity. A bank guarantee is a banks promise that liabilities of a debtor will be met if he does not fulfi l contractual obligations. In such a case the bank will pay the.

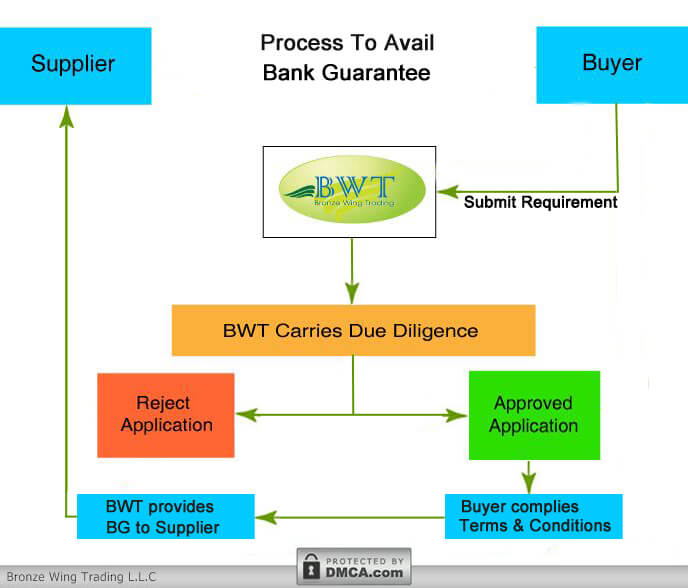

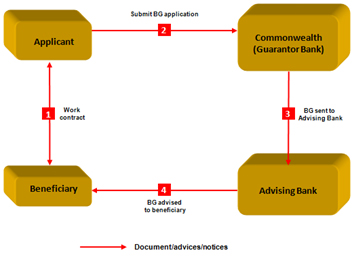

A bank guarantee is a formal assurance from the bank which makes sure that the liabilities of a debtor will be met. These 2 parties have to comply to apply for bank guarantee. When a bank signs a bank guarantee it promises to pay any amount according to the request made by the borrower. Find out how bank guarantees work why they are issued and the process that a business normally goes through to acquire one from a bank.

Hence signing a bank guarantee implies a high risk for banks. The applicant needs to apply to the bank to provide a guarantee for the loan taken from the creditor. Most of the bank guarantee required lesser documents so processed quickly if all document are correct and submitted successfully to the banks. This is usually seen when a small company is dealing with much larger entity or even a government across borderlet us take an example of a company xyz bags a project from say the government of ethiopia to build 200 power transmission towers.

A bid bond guarantee ensures that the winning bidder of a project accepts and executes it as per contract. In such circumstances approach your bank and ask it to stand as a guarantor on your behalf. This concept is known as bank guarantee bg. First an applicant will ask for a loan from a beneficiary or creditor.

Understand the process of bank guarantee. Bank guarantee can be claimed only when the seller has performed his part of the contract and the issuing banks client buyer has failed to make the paymentin other words it is always the obligation of the buyer to pay for the purchaseborrowing and only if he is unable to make the payment on the date of payment the bank guarantee can be put to use. First the applicant will apply for a loan from the beneficiary or a creditor. This tutorial explains what is sap bank guarantees and sap bank guarantees process.

In other words if the debtor fails to settle a debt the bank covers.