Bank Of England Base Rate History Graph

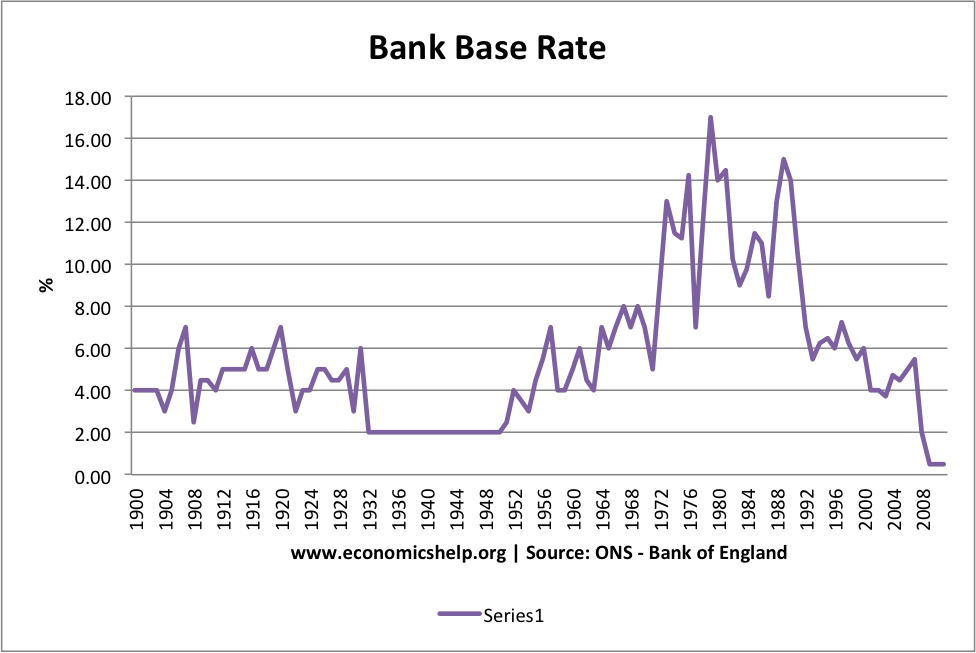

The current name official bank rate was introduced in 2006 and replaced the previous title repo rate repo is short for repurchase agreement in 1997.

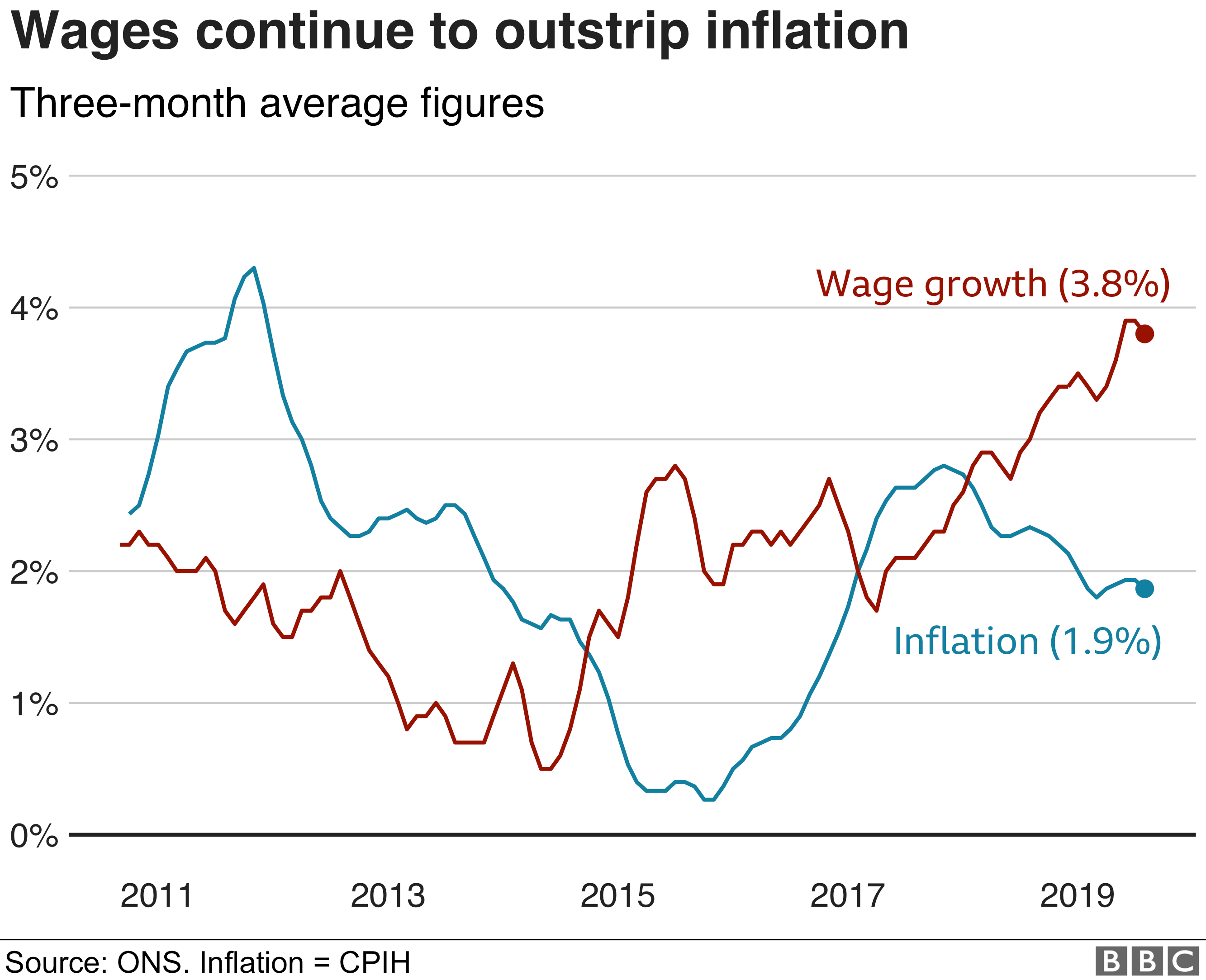

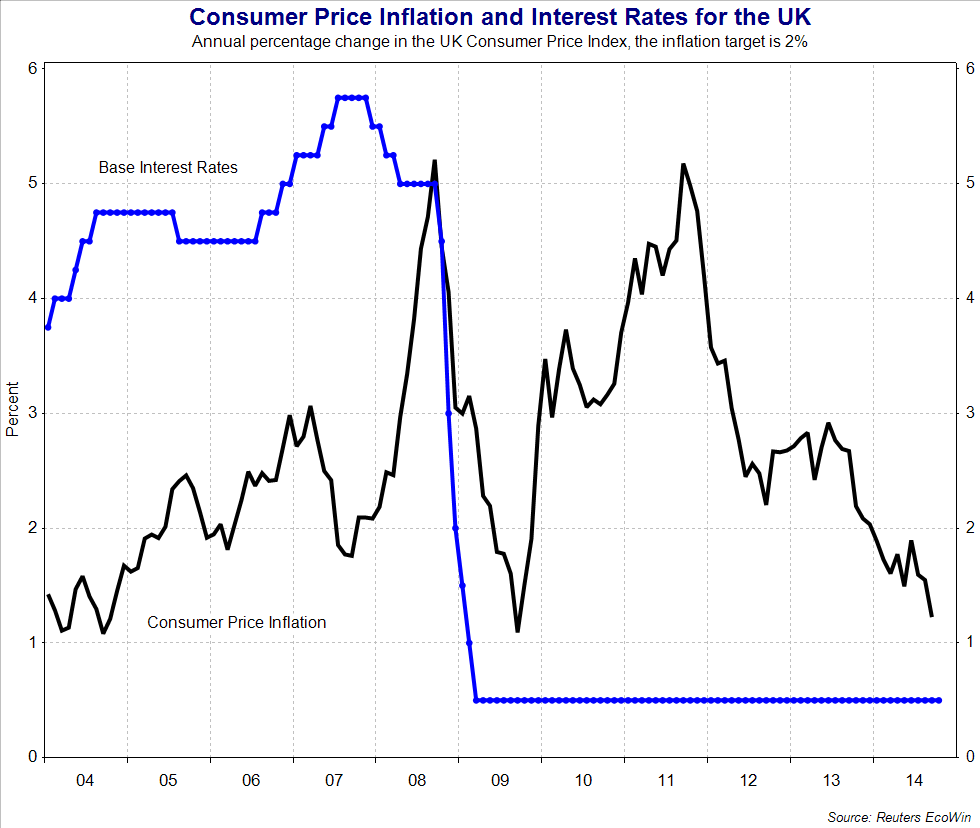

Bank of england base rate history graph. United kingdom interest rate data historical chart forecasts and calendar of releases was last updated on may of 2020. In the news its sometimes called the bank of england base rate or even just the interest rate. Quick uk interest rate stats. 1700 on nov 1979.

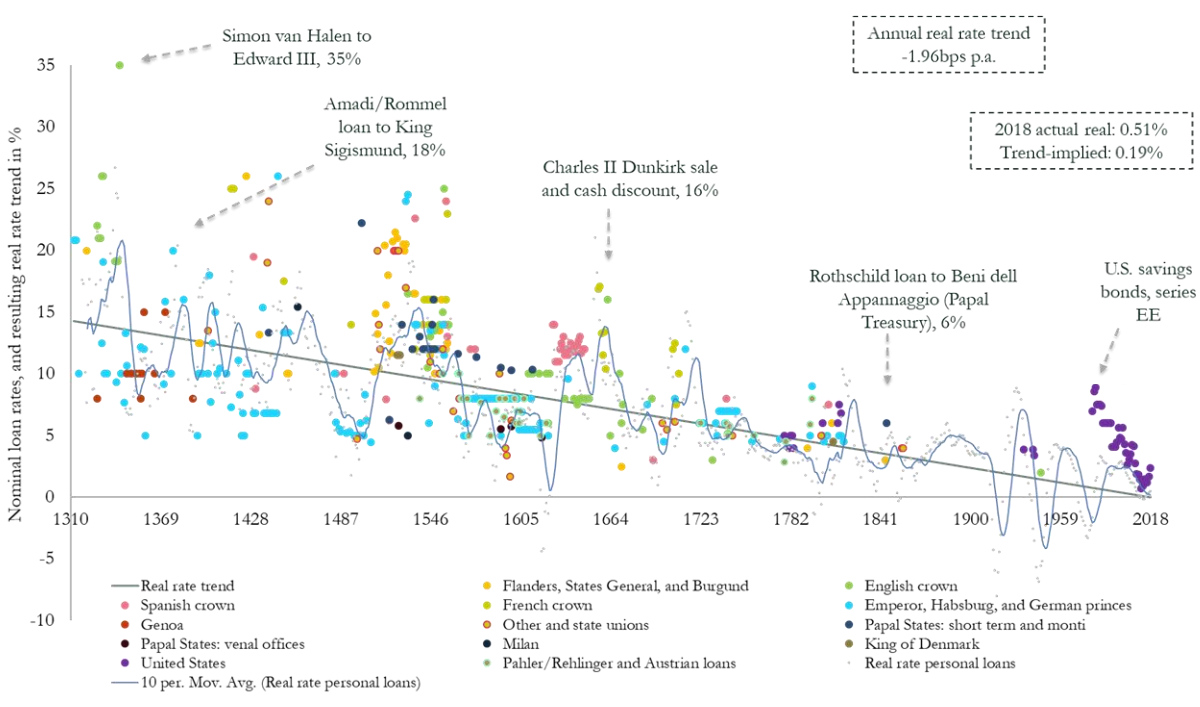

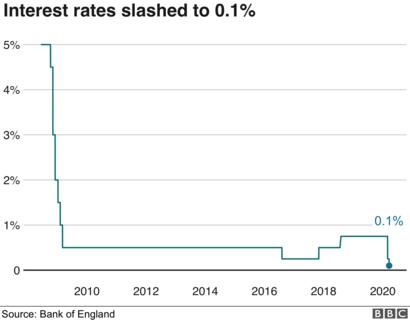

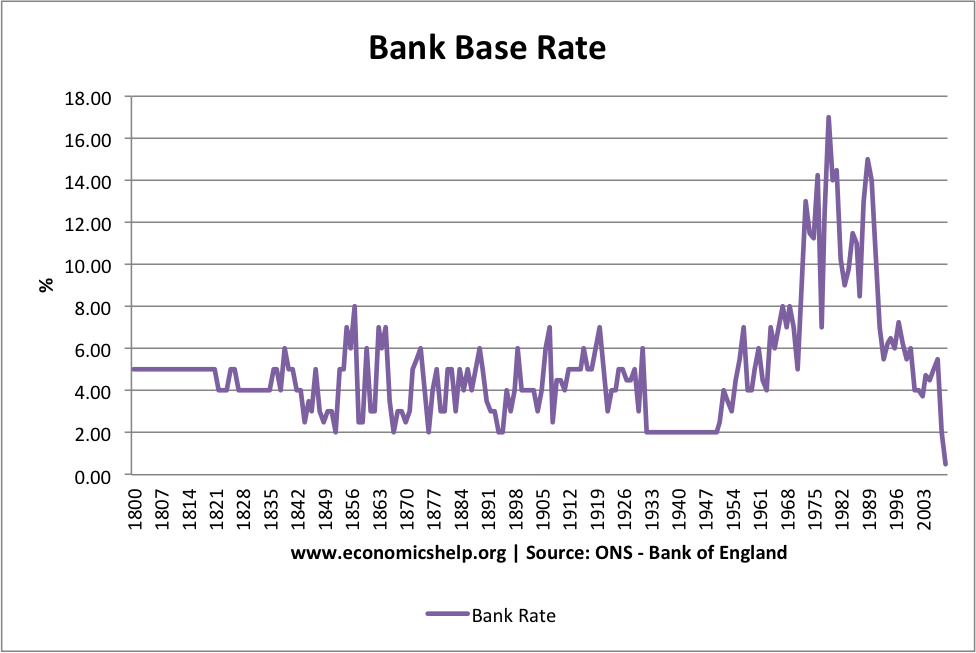

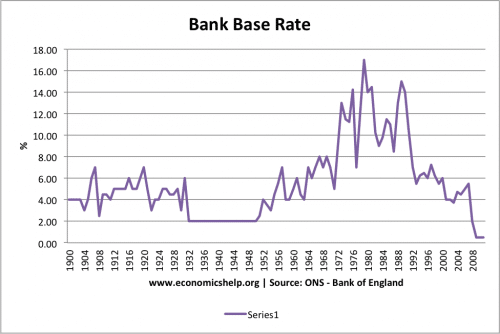

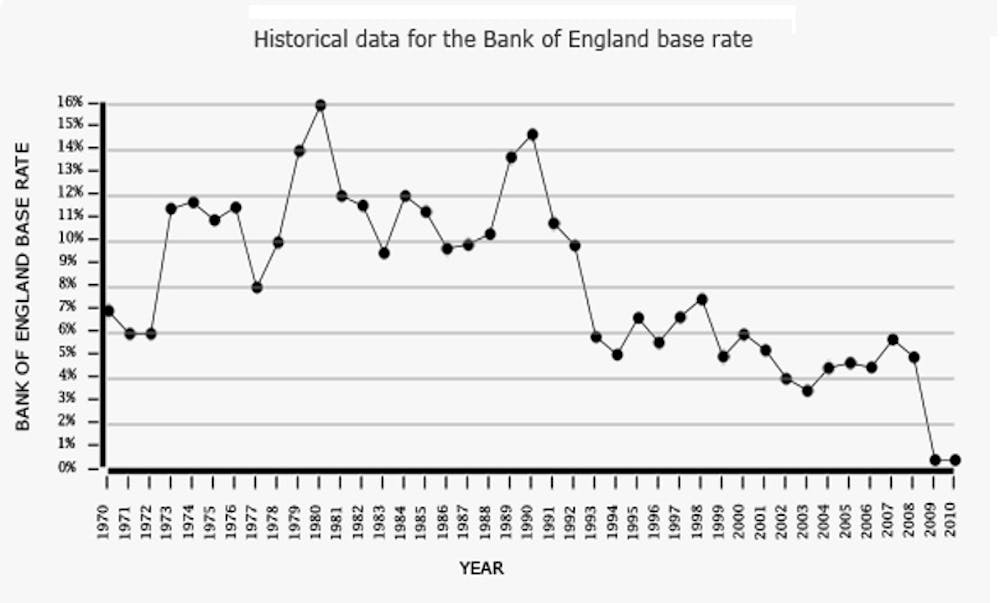

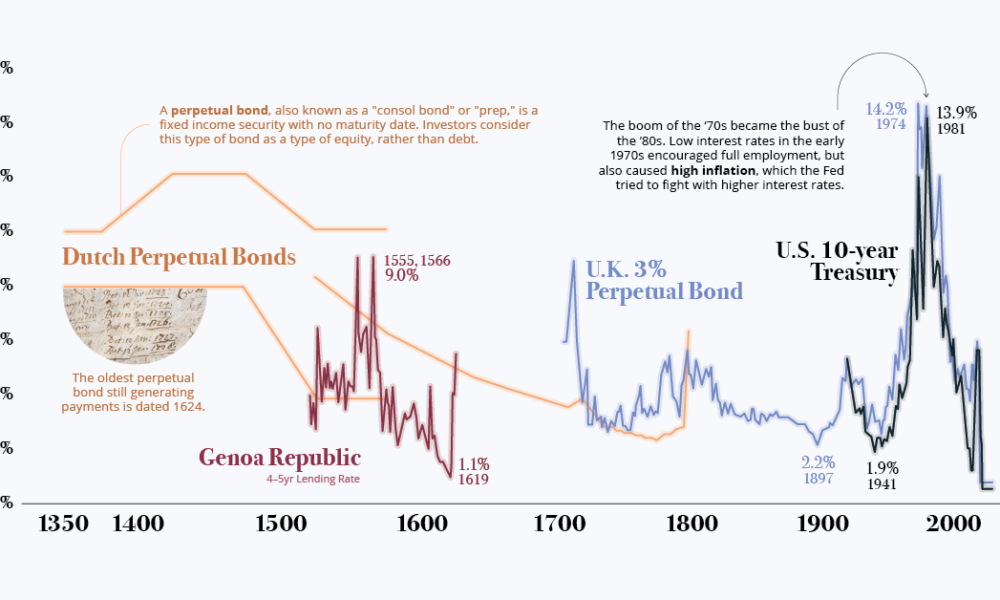

010 on 19 mar 2020. The official bank rate has existed in various forms since 1694 and has ranged from 01 to 17. A base rate increase in october 1981 saw rates at their highest ever point. Our monetary policy committee mpc sets bank rate.

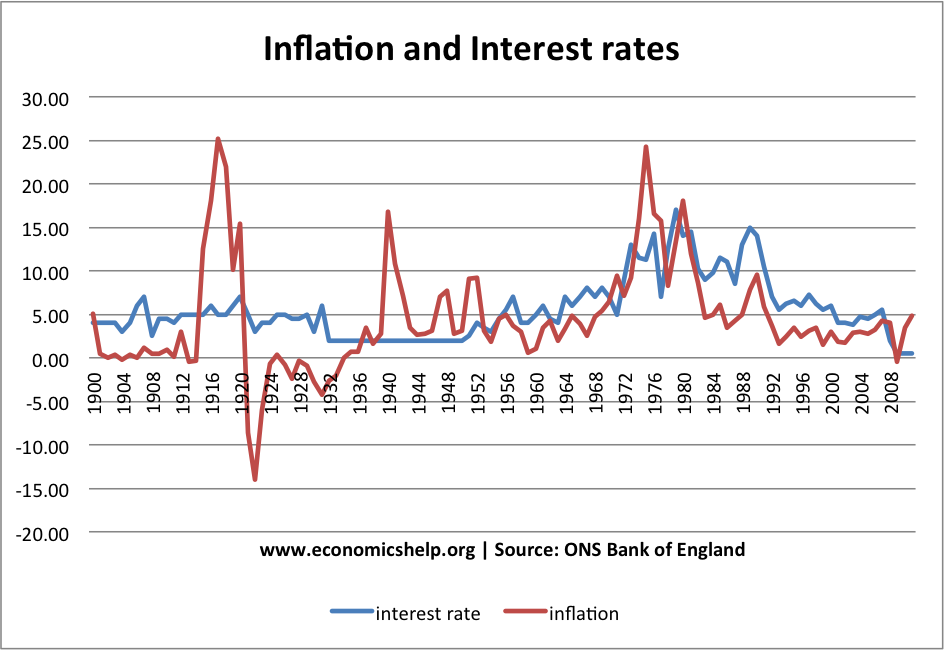

2003 2007 interest rates were raised significantly in this period as an attempt to reign in what was perceived to be an over inflating economy. The uk base rate is the interest rate at which commercial banks like barcleys and natwest borrow from the bank of england. The name of this key interest rate has changed over the years. Following the global financial crisis in 2008 bank of england gradually cut the base rate from 55 down to just 025 in august 2016 historically the lowest interest rate the uk has ever seen.

These rates from the bank of england go back to 1694 which as any history student will tell you is actually before the formation of the uk in may 1707but it is one of the worlds most. In theory lower the interest rate the cheaper loans. The bank of england has been setting the interest rate in the uk since way back in 1694. Current uk interest rate.

Hier sollte eine beschreibung angezeigt werden diese seite laesst dies jedoch nicht zu. Bank of england base rate history. The election of tony blairs administration was accompanied by the new chancellor gordon brown handing control of the setting of the base interest rate to an independent bank of england. Bank of england base rate history over the course of the boe base rate history rates have fluctuated.

Bank of england interest rate in the united kingdom is expected to be 010 percent by the end of this quarter according to trading economics global macro models and analysts expectations.

:max_bytes(150000):strip_icc()/fredgraph1-5c4216c046e0fb0001b804e0.png)