Importance Of Digital Banking In India

The trend was picked up by many banks and at present most of the banks provide internet banking facilities.

Importance of digital banking in india. Digital banking should not be looked at just as a technological advancement. Automation is one of the biggest focuses that banks are looking at. The following article will help you gain more insight on this topic as different aspects of digital banking are discussed with more elaboration. With this objective electronic clearing.

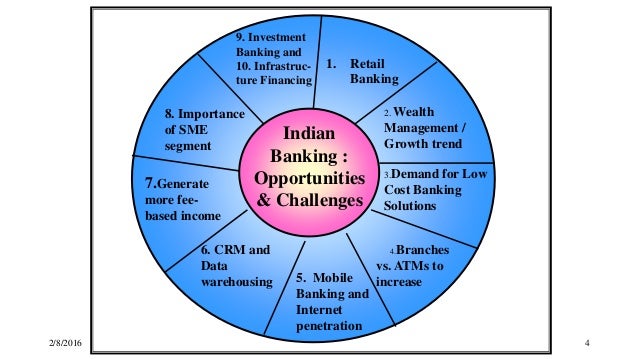

Digital transformation is far beyond just moving from traditional banking to a digital world. Banks need to invest in building more capabilities to enhance service simplicity availability and interoperability. The digital revolution has changed many elements within almost every industry especially the financial industry. Government of india and rbi as part of digital india and financial inclusion agenda have launched a slew of initiatives and changes to enhance penetration.

Digital banking has revolutionized the banking industry in india. It is a vital change in how banks it is a vital change in how banks and other financial institutions learn about interact with and satisfy customers. We have only discussed some aspects of digital banking in india or digital india in the banking sector and the future of digital banking in india. Digital india is an initiative by govt of india to help the country adopt digital initiatives.

How important is digital banking in the modern world. Initiatives which are expected to cut dependency on bureaucratic processes decrease corruption and help cut down time in taking public services to the citizens of the country. The first bank to provide online banking service was icici bank in the year 1996. It is a revolution in how the banking industry functions and the services it renders.

Transition and interoperability related issues viz. Digital banking provides mission critical solutions to bankers for their short term and long term business and technological. Easier and faster transactions custo. Use it and its importance increased gradually.

Neither is it a customer service initiative. The online services include making transactions checking bank statements submitting requests and other banking activities. From traditional banking to state of the art digital banking such as data integrity authentication including third party authentication and trust factors in a digital banking environment are gaining importance. As the population increased in india the need of atms also increased in various parts of the country so in order to reduce the rush of atms rbi focused on introducing e banking in the country.

The main focus of reserve bank of india rbi was to ensure safer and authorized payment system to the people.

:max_bytes(150000):strip_icc()/check-your-bank-balance-online-315469-FInal-65f751f553e34e7cb1852e957d917745.png)